Bonus Items

We also feature:

US Presidential Year Cycles On

-

S&P500

-

Crude Oil

-

Euro

-

British Pound

-

Australian Dollar

-

Japanese Yen

-

Gold

-

Silver

-

US 10 Year Notes

US Sector Seasonality

-

Consumer Discretionary

-

Consumer Staples

-

Energy

-

Financials

-

Healthcare

-

Industrials

-

Materials

-

Utilities

-

Technology

Stock Index Seasonality

-

S&P500

-

VIX Futures

-

Dow Jones Industrial Average

-

NASDAQ 100

-

French CAC

-

Japanese Nikkei

-

Hong Kong Hang Seng

-

Australian All Ordinaries

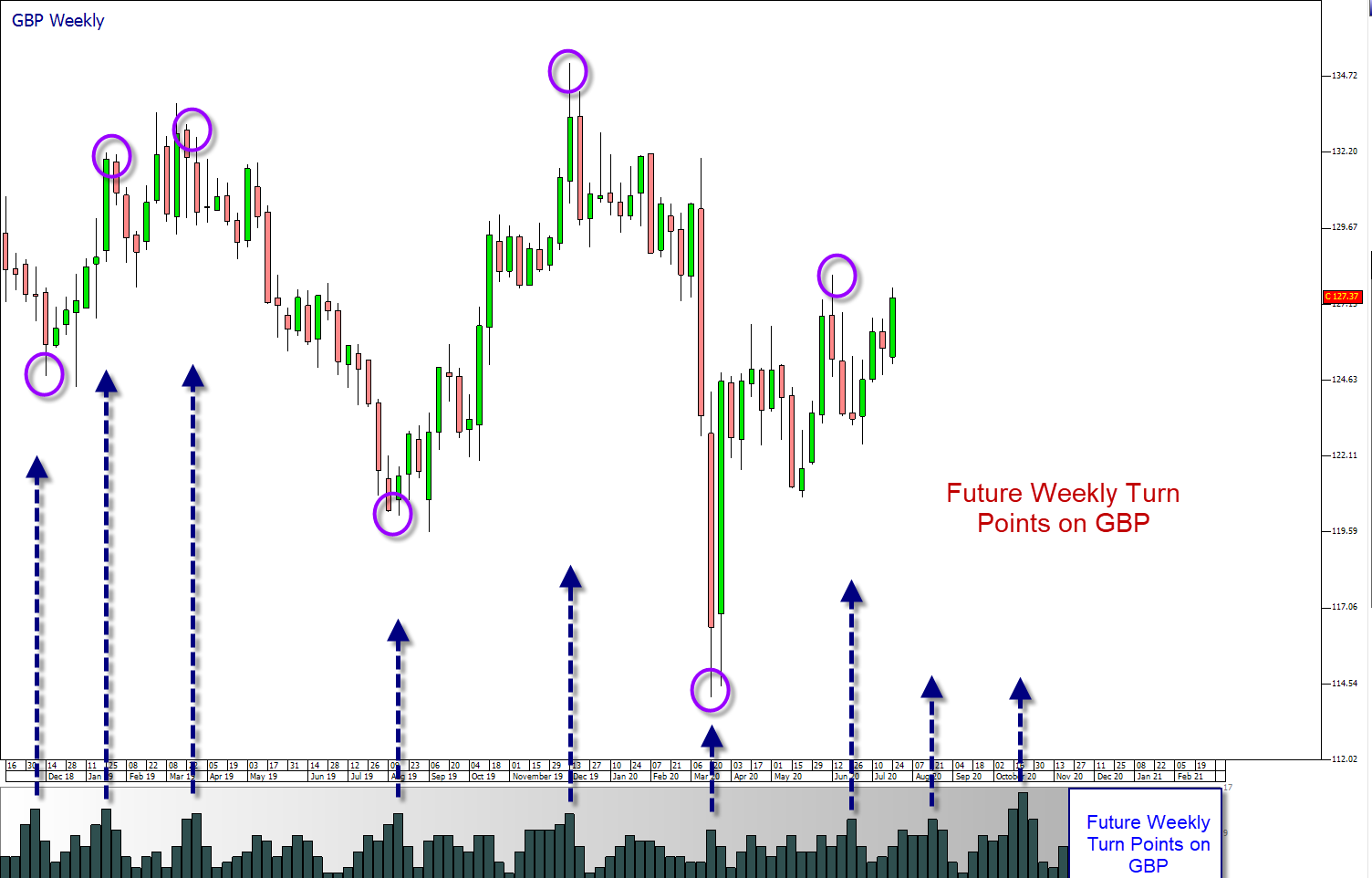

Proprietary Weekly "Profit Finding Oracle" Time Cycles On

-

Australian Dollar

-

British Pound

-

Canadian Dollar

-

Euro

-

Japanese Yen

-

New Zealand Dollar

-

Swiss Franc